How to Build Credit From Scratch: The Ultimate Beginner-Friendly Guide

Imagine walking into a bank, excited to apply for your first apartment, only to hear:

“Sorry, we can’t approve you. You don’t have a credit history.”

Frustrating, right?

Whether you’re new to the U.S., fresh out of school, or just starting your financial journey, building credit from zero can feel overwhelming. But here’s the truth: credit isn’t just a score – it’s a key to opportunities.

Good credit can help you rent a home, buy a car, start a business, and even save money on insurance and interest rates. At Orolaia, we believe financial confidence starts with clear, shame-free guidance. In this guide, we’ll walk you through exactly how to build credit from scratch, step by step, so you can start building the life you want.

No Credit ≠ Bad Credit

Having no credit history is not the same thing as bad credit – but both can hold you back.

- No Credit: You simply haven’t had a chance to show lenders you can handle debt responsibly. It’s like applying for a job without a résumé.

- Bad Credit: You’ve made mistakes in the past, like missed payments or carrying too much debt, and lenders now see you as risky.

When you have no credit, lenders don’t know whether to trust you, so they either deny your application or approve it with very high interest rates.

The good news? Building credit from scratch is easier than repairing bad credit. With the right strategy, you’ll be on your way to a strong credit history faster than you think.

Why Building Credit Matters

Strong credit doesn’t just make you “look good” on paper. It opens doors in almost every area of life:

- 🏠 Housing: Landlords often check credit before renting.

- 🚗 Transportation: Your credit score impacts auto loans and leases.

- 💳 Better Financial Products: Higher credit limits, lower interest rates, rewards cards.

- 📈 Entrepreneurship: Some business loans require good personal credit.

- 💼 Job Opportunities: Certain employers check credit as part of background checks.

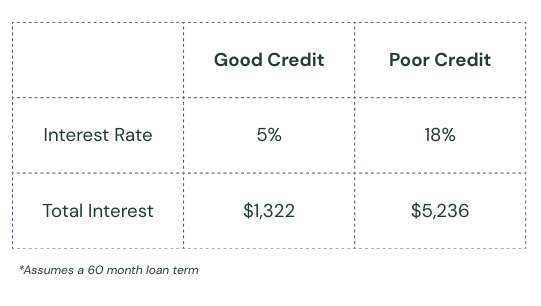

Example:

Let’s say you need to borrow $10,000 for a car. With good credit, you might get a 5% interest rate; whereas with poor credit, you might get an 18% interest rate, costing you nearly 4x in interest payments over the life of the loan. Building credit now = saving thousands later.

5 Steps to Build Credit From Zero

Here’s your clear, step-by-step path to establishing credit history:

Step 1: Open a Secured Credit Card

A secured card is perfect for beginners because approval is much easier.

- You’ll put down a refundable deposit (usually $200–$500).

- Your deposit becomes your credit limit.

- Use the card for small, regular purchases (like gas or groceries), then pay it off in full each month.

💡 Orolaia tip: Look for secured cards with no annual fee and ones that graduate to an unsecured card after 6-12 months of responsible use. Examples include:

Step 2: Consider Becoming an Authorized User (Optional)

If you have a trusted family member or friend who’s been using credit responsibly, they can help you jumpstart your credit journey by adding you as an authorized user on their card.

- Their account history shows up on your credit report, giving you a head start on building your own history.

- You don’t even need to use their card. Simply being on the account benefits your score.

But here’s the thing: this step isn’t right for everyone, and that’s okay.

- If the other person misses a payment or carries a high balance, it can hurt your credit.

- Some families simply aren’t ready to mix money and credit – and that’s completely normal.

💡 Orolaia Tip: If you don’t have someone who can add you as an authorized user, don’t worry! You can absolutely build strong credit on your own. Starting with a secured credit card (Step 1) is a safe, independent path that works for anyone, especially if you’re new to the U.S. or the first in your family to navigate the credit system.

Step 3: Use Your Card Responsibly

Credit is built on consistent, smart habits.

- Aim to use 10–30% of your available credit limit. Example: If your limit is $300, keep balances under $90.

- Pay on time, every time. Even one late payment can cause a big drop in your score.

Step 4: Automate Your Payments

Life gets busy. Automating your credit card payments ensures you never miss a due date.

- Set up autopay for at least the minimum amount due.

- This small step eliminates the risk of forgetting and protects your credit score.

Step 5: Check Your Credit Score Regularly

Tracking your credit helps you see progress and catch mistakes early.

- Use free tools like Credit Karma, Experian, or your bank’s app to track your progress.

- Regular check-ins help you catch errors early and stay motivated.

Common Mistakes to Avoid

Don’t let these traps derail your progress:

- Applying for too many cards at once → Each application triggers a “hard inquiry” that temporarily lowers your score.

- Co-signing loans too soon → If the other person misses a payment, you’re responsible.

- Carrying a balance on purpose → You don’t need to pay interest to build credit. Pay your balance in full if you can.

- Ignoring your credit report → Check for errors at AnnualCreditReport.com (free once a year).

Free guide: Download the Credit Confidence Checklist to learn the five most common credit mistakes and how to fix them.

Your Next Step Toward Financial Confidence

Building credit might feel intimidating, but remember: everyone starts somewhere.

By taking small, consistent steps, you’ll build a strong financial foundation and open doors to new opportunities for yourself and your family.

At Orolaia, our mission is to help you navigate money with confidence, without shame or judgment.

Ready to take your next step?

- Download our free Credit Confidence Checklist to avoid costly mistakes.

- Explore our Money Confianza™ coaching program for personalized support.

You’ve got this. And we’re here to help you every step of the way.