What Is a Good Credit Score? The Ultimate Guide to Understanding Good Credit

Your credit score isn’t just a number; it’s a powerful tool that can open doors to opportunities. Whether you’re buying your first car, renting an apartment, or even starting a business, your credit score plays a huge role in what’s possible.

But let’s be real: if you didn’t grow up talking about credit around the dinner table (many of us didn’t!), it can feel overwhelming or even intimidating. That stops here.

This guide will break down everything you need to know about credit scores: what counts as “good”, why it matters, and how to improve yours step by step.

💡 Want to skip straight to action? Grab our free Credit Clarity Checklist, a no-shame guide that walks you through common mistakes and how to fix them. It’s available in English and Spanish!

What Is a Credit Score?

A credit score is a three-digit number that shows lenders how trustworthy you are with money. Think of it as a financial report card that reflects how well you handle borrowing and paying back money.

The most common scoring model is FICO, which ranges from 300 to 850. The higher your score, the easier it is to get approved for loans, credit cards, or even to rent an apartment – often with better terms and lower interest rates.

What Is Considered a Good Credit Score

Now, the big question: What is considered a good score?

Here’s how FICO breaks it down:

✨ Pro Tip: If your score isn’t where you want it to be yet, don’t stress. Improving your credit is a journey, and small, consistent steps can make a huge difference over time.

💡 Did you know there are different scoring models?

The two most common are FICO and VantageScore.

- FICO is used by about 90% of top lenders, so that’s the one we focus on in this guide.

- VantageScore is similar but may show slightly different ranges.

If you see your score vary a little between apps or websites, don’t panic – that’s completely normal!

Why Having Good Credit Matters

Your credit score isn’t just a number – it’s a reflection of your financial habits and trustworthiness. It can impact almost every area of your life:

- Loan approvals: Lenders are more likely to say “yes” when you have a strong score.

- Interest rates: Higher scores = lower rates, saving you hundreds or even thousands over time.

- Renting an apartment: Many landlords check credit before approving leases.

- Utilities and cell phone plans: Some companies require a deposit if your credit is low.

- Job opportunities: Certain employers check credit as part of their hiring process.

For many of us, building good credit is also about breaking cycles. If you didn’t grow up with access to financial education or resources, having strong credit can be a game-changer- for you and for future generations in your family.

Good credit = more opportunities and lower costs. A strong score can save you thousands of dollars over time in interest and fees, while a low score can make it harder (and more expensive) to achieve your goals.

The 5 Factors That Make Up Your Credit Score

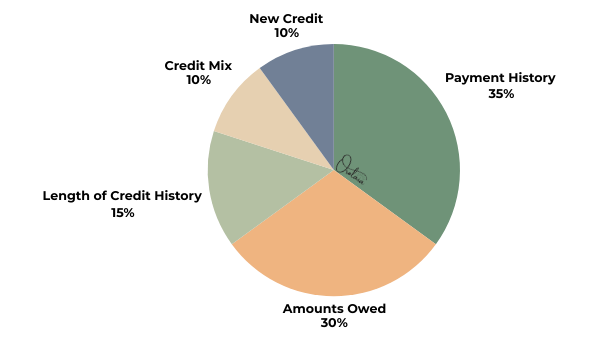

Your credit score is like a recipe – each ingredient plays a role. Here’s the exact breakdown of how FICO scores are calculated:

As you can see in the chart above, not all factors carry the same weight. Below, we’ll break down what each one really means, and how you can use this knowledge to take control of your credit and create more opportunities for you and your family.

- Payment History (35%) – Paying your bills on time is the #1 factor. Even one late payment can hurt your score and stay on your report for up to 7 years.

- Amounts Owed / Credit Utilization (30%) – High balances or maxed-out cards can lower your score. Aim to keep utilization under 30%.

- Length of Credit History (15%) – The longer your accounts are open, the better. Keep old accounts active, even if you don’t use them often.

- New Credit (10%) – Too many recent credit applications can be a red flag for lenders.

- Credit Mix (10%) – A variety of credit types, like cards, loans, or a mortgage, helps show you can manage different responsibilities.

💡 Pro Tip: Set up automatic payments to never miss a due date. Even one late payment can stay on your report for seven years, but on-time payments steadily build your score.

How to Improve Your Credit Score

Improving your score doesn’t happen overnight, but small, consistent actions can make a huge difference. Here’s where to start:

1. Pay Bills on Time

This is the single most important thing you can do. Pay at least the minimum amount every month to avoid late fees and damage to your score. If you can, pay the balance in full – this helps you avoid paying interest and keeps your credit utilization low.

Even one late payment can drop your score significantly, so stay ahead by using reminders or autopay.

2. Keep Credit Utilization Low

Your credit utilization ratio is how much of your available credit you’re using.

- Aim to keep it below 30%, and ideally under 10%.

- Example: If you have a $1,000 limit, try not to carry a balance over $300.

3. Avoid Opening Too Many New Accounts

Each application creates a hard inquiry, which can slightly lower your score temporarily. Only apply for new credit when necessary and space out applications.

4. Build a Mix of Credit

If possible, diversify with both revolving credit (like credit cards) and installment loans (like auto or student loans). This shows lenders you can handle different types of credit responsibly.

5. Check Your Credit Reports Regularly

Mistakes happen! You’re entitled to one free credit report per year from each of the three major bureaus through AnnualCreditReport.com. Look for errors like incorrect balances or accounts you don’t recognize, and dispute them right away.

Debunking Common Credit Myths

Many people, especially in our community, grow up hearing myths about credit. Let’s clear up a few big ones:

- Myth #1: You need to carry a balance to build credit.

❌ False. You can pay your balance in full each month and still build credit. That’s the smartest move for your credit and wallet. - Myth #2: Checking your credit score hurts it.

❌ False. When you check your own score, it’s considered a soft inquiry, which doesn’t affect your credit. Regularly monitoring your credit is a smart habit. - Myth #3: You need perfect credit to get approved.

❌ False. Many lenders approve borrowers with scores in the Good range. You don’t need an 850! - Myth #4: Closing a credit card always helps.

❌ False. Actually, closing your oldest account can hurt your score by shortening your credit history. Instead, keep old cards open and use them occasionally. - Myth #5: Immigrants can’t build credit without a Social Security Number.

❌ False. There are options like ITIN loans and secured cards designed to help you start building credit.

💡 Want a simple guide to building credit from scratch? Grab our free Credit Clarity Checklist – available in English and Spanish.

Rewrite Your Money Story, One Credit Step at a Time

Your credit score is more than a number; it’s a reflection of your financial journey and an opportunity to rewrite your money story.

Whether you’re starting from scratch or rebuilding after challenges, remember this: you have the power to change your future. With every on-time payment, every smart choice, and every lesson learned, you’re creating a better path not just for yourself, but for the generations that come after you.

Ready to start building a credit score that opens doors? Check out our beginner’s guide to building credit and take your first step toward financial confidence today.